Services

Summary:

- Macroeconomic analysis

- Fundamental company analysis

- Governance for value creation

- Oversight of risk management

- Value creation cycle improvement

Investor Outcome Acceleration

Macroeconomic insight distinctively illustrated in pictures that reveal often unseen data details. Based on The Economic Picture Book and Feddashboard.com.

Business Model Investing fundamental company analysis distinctively uncovering patterns in business models to provide more insight than typical "quant" to factor approaches.

Value-Added Diamond integrates aspects of strategy, product management and operations to generate a view of “what good looks like” in company business models. Designed for corporate planning, it can also be mined for fundamental investment analysis.

Board Member Outcome Acceleration

Governance for Value Creation

Directly addresses the most vexing problems in board room decision-making to reduce the risk of investor-issuer conflict:

- Creating a safety zone to allow the board space to focus on long-term value creation.

- Discerning investor time horizons.

- Aligning strategy and executive compensation.

- Explaining your story to shareholders, analysts and other external stakeholders.

Lead presenters for this workshop are Jon Lukomnik of Sinclair Capital and Brian Barnier.

Macroeconomic insight distinctively illustrated in pictures that reveal often unseen data details. Based on The Economic Picture Book and Feddashboard.com.

Designing for performance (and for longer term investors) -- business model-based strategy

- Bringing corporate strategy portfolio approaches (especially those designed to drive sustainable financial returns) to investor portfolios.

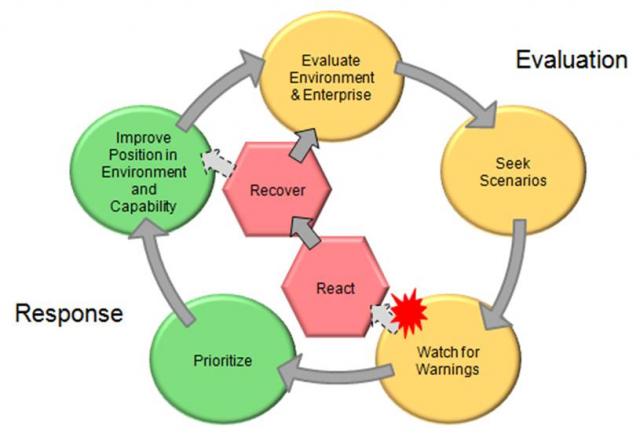

- Overcoming the challenges of the three catalysts of risk – change, complexity and fatigue – through the 5+2 step cycle of situational evaluation and response, stressing situation shaping.

Oversight of management of risk to performance objectives - 4 functions of a governor

- Shifting from a compliance/controls-driven approach to a performance-driven approach. Designed to help board members, based on their objectives, improve in each of the four roles of the governor.

- Better coordination with CEOs, corporate secretaries and heads of operations, finance, IT, audit and others.

- "How much do I need to know?" situational awareness for board members.

"Go time," creating crisis-ready board members

- Scenario-based approach to refine board preparation and response in view of board member personalities and expertise to reduce risk of impaired decision-making in times of change, complexity and fatigue.

Lead presenters for this workshop are Brian Barnier and Suzanne Bernier. Crisis-ready personality assessment provided by Donna Hamlin of Intrabond Capital. Additional experts based on industry and country.

Which dot are you? An fundamental investor perspective of your company- Describes how investors use fundamental analysis tools to slice, dice and compare your financial results -- and why engineered earnings are difficult to hide.

Before the 13D, creating investor-ready board members

- Perspectives on investor-issuer engagement in an environment where investors increasingly seek direct conversation with board members.