ValueBridge Advisors

More safely seizing opportunity to GROW

Operating Company Risk Leaders

Managing risk to objectives -- lives and livelihoods -- by managing risk to decisions

Distinctive approach

To grow corporate valuation in this economic environment.

Emphasized actions to achieve outcomes include:

- Managing risk to business performance by better managing risk in decision processes and individual decisions, both frequent (daily activities) and infrequent (investments or emergency response)

- Focusing on systems and causes instead of “loss events”

- Identifying and overcoming the three catalysts of risk – change, complexity and fatigue

- Making the sharp distinction between risk management program and actually managing risk to business objectives

- Managing risk must be simple in order to use it daily in a dynamic world. Complex risk management programs on top of daily complexity and change increases risk.

- Improving efficiency and effectiveness through performance-driven approaches to managing risk that draw on decades of proven practice in strategy, operations, finance and organizational change, rather than compliance/control-based approaches.

- Skill in managing risk as the ultimate differentiator

Services

Summary

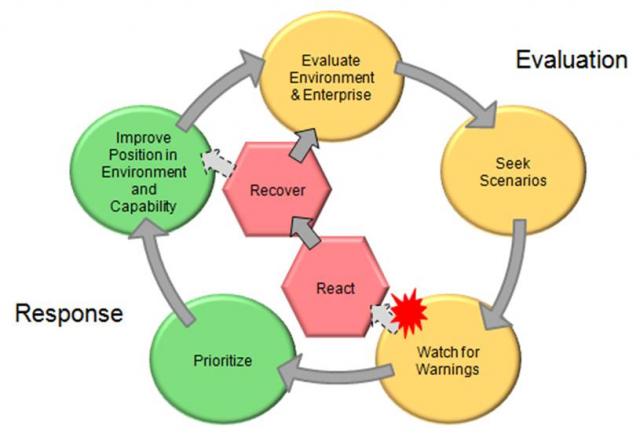

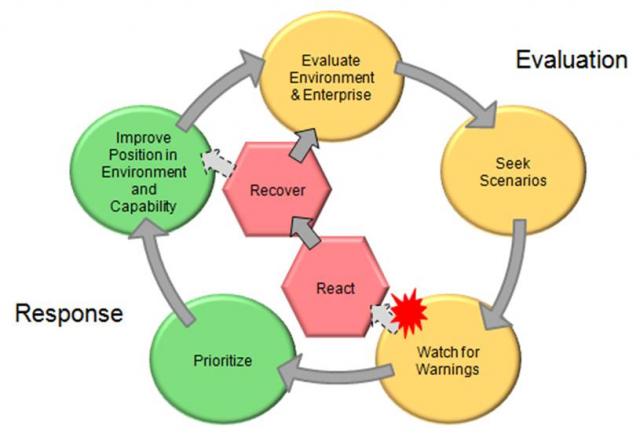

- Evaluation of Risk - knowing the business, asking "what if?" and watching for warning signs

- Scenario analysis

- Response to Risk - prioritizing, improving, reacting and recovering

- Business cases for improvement

- Incentive alignment

Outcome acceleration

Core Fitness -- Managing risk to business performance the 5+2 way

- Managing risk to objectives is fundamental to business (strategy, products, sales, operations) as it is to sports, baking a cake or driving a car.

- As described in The Operational Risk Handbook, this workshop is designed to apply that practical performance-driven approach to provide more actionable insight for strategy plan, process and implementation decisions. Better decisions lead to better outcomes.

Scenario analysis – heart of managing risk

- Scenario analysis, asking "What if?" is the heart of managing risk.

- If this fails, all else fails.

- This workshop is designed for hands-on practice with this approach to bring more practical benefit to current business situations.

Traction time -- Activity-specific scenario analysis workshops.

- Focused on a single business area (e.g., line, geographic or product) they are rapid action to engage that team and better manage risk to operational and financial performance objectives.

Train the facilitator – a 3 step approach to build capacity for sustainable change in an organization.

- Step 1 is a knowledge transfer workshop where a group of facilitators is trained.

- Step 2 a trainer(s) assists a ValueBridge Advisors facilitator of a “Traction Time” workshop.

- Step 3 the trainee is the facilitator of a “Traction Time” workshop and a VaueBridge Advisors facilitator assists the trainee to “graduate” to independence.

Performance by paycheck – Managing risk through performance and compensation.

- Overcome the frequent problem of multiple measures (often made worse by so-called “risk appetite” statements) pulling people in multiple directions.

- Simplify and speed progress toward more efficient and effective daily management of risk as people make daily decisions.

Outcome acceleration delivery

- Outcome acceleration workshops

- “Teach to fish” personal guidance for the dynamics of your role and your organization

- Accelerator widgets -- diagnostics, actions and progress measures to accelerate alignment gap closure

- Conversation clarifiers to cut churn; and improve situational awareness and alignment with management, board or investors